Compulsory Liquidation

Entering compulsory liquidation - "winding up" is one of the worst insolvency processes and should be avoided whenever possible.

If a limited company is unable to pay creditors as and when they become due, it may be forced into compulsory liquidation. This is a legal process that involves selling off the company’s assets to pay its creditors. In this guide, we’ll explore what compulsory liquidation is, the reasons why a company may be forced into liquidation, and what happens during the process.

What is Compulsory Liquidation?

Compulsory liquidation proceedings, also known as "winding up" is a court driven process that occurs when a company is unable to pay its debts. One or more of the company's creditors will apply to the Court for a Winding up Petition to be issued for the company to be placed in compulsory liquidation. The company bank account(s) will be frozen once the petition has been issued; so you need to act quickly if you want to stop the process.

If the hearing is successful from the point of view of the petitioning creditor, the Court will issue a Winding up Order and the company will cease to trade immediately. The official receiver will seek to sell off the company assets to pay its creditors. Alternatively, the official receiver may appoint a licensed insolvency practitioner in the role of liquidator to oversee the process.

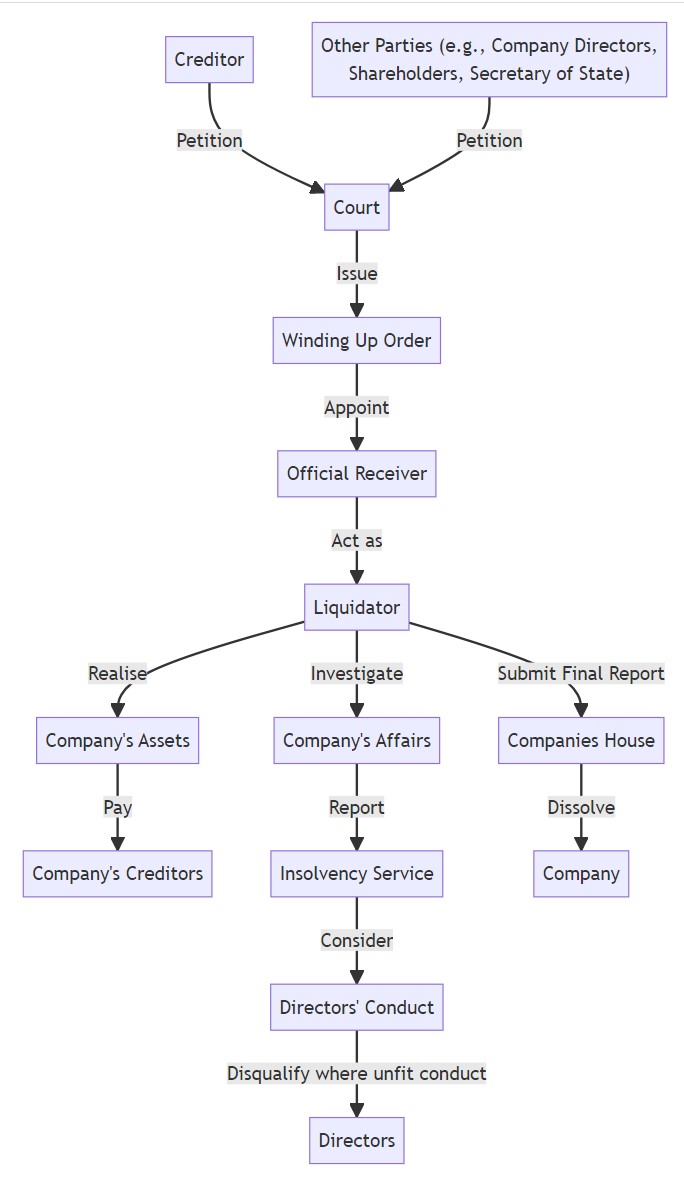

What is the process of a compulsory liquidation?

A compulsory liquidation is initiated by a winding-up petition. If Creditors of an insolvent company are owed more than £750 and can demonstrate that the company cannot pay its debts, they may initiate court proceedings to force it into liquidation.

When a Court makes a winding up order, the company is placed into liquidation and this gives control to an officer of the court, the Official Receiver. The compulsory liquidation process involves several steps including:

- Statutory demand: The statutory demand serves as a formal request for payment of a debt owed to the petitioning creditor. Should the company neglect to pay off the debt within 21 days after receiving the demand, the creditor has legal grounds to file a winding-up petition.

- Court hearing: If the Court accepts the Winding-up Petition, it will set a hearing date to decide whether to make a Winding-up Order. The Winding-Up-Petition will be advertised in the Gazette. The company can oppose the winding up petition at the hearing by attending and presenting evidence as to why it should not be granted. However, if the court issues a winding-up Order, the official receiver will take control of the company's assets.

- Notification of liquidation: The appointed liquidator will inform all stakeholders of a company's liquidation, such as creditors, shareholders and employees. Furthermore, an in-depth investigation will be conducted to examine the affairs of the company and report upon the conduct of directors. If necessary, legal proceedings can be taken against directors. NB: You can be banned from being a director for up to 15 years if you do not carry out your duties properly.

- Asset liquidation: The Official Receiver will sell the company's assets and use the proceeds to pay off the company's debts. The official receiver will also investigate any potential fraudulent or wrongful activities that may have led to the company's financial difficulties.

- Company Closure: Once the appointed liquidator has completed all their duties and all company assets have been realised and distributed, the liquidator will issue their final report to all parties including the Insolvency Service. The company will then be formally closed struck off the register at Companies House.

By understanding the process of a compulsory liquidation, individuals can take appropriate steps to avoid it and protect their financial interests.

How long does compulsory liquidation take?

The length of time it takes to complete a compulsory liquidation can vary depending on the complexity of the case and the size of the company. In general, the process can take anywhere from six months to a few years.

Following the granting by the court of a Winding up Order, the company will be required to cease trading immediately and all employees will be made redundant.

The company is now officially in liquidation and an Official Receiver is appointed to administer the process. This will involve selling off all of the assets in order to pay back creditors. Furthermore, the liquidator must investigate any potential misconduct during their administration.

For further information, please read our guide on what you can expect to happen during the liquidator's investigations process.

Once the liquidation process has completed with all the company assets sold and funds distributed, the company will be dissolved. It is important to note that the liquidation process can be time-consuming and complex so it is essential seek professional advice from an insolvency practitioner or other expert if you are faced with the prospect of compulsory liquidation.

What happens to employees following a Winding up Order?

After the winding up order has been approved and compulsory liquidation starts (upon appointing a liquidator), the employee contracts will be terminstaed and they will be dismissed from their positions. Consequently, they become creditors of the company claiming payments for unpaid wages, payment in lieu of notice, redundancy pay, and holiday pay.

- Payments from the liquidated company

During a company liquidation, preferential creditors must wait until the liquidator's fee and secured creditors like banks are paid before they receive their money. This often leaves insufficient funds to cover all of the employee claims.

- Submitting a claim through the Redundancy Payments Service

If there are not enough resources to pay employees upon a company's liquidation, those affected may be eligible for redundancy and other payments from the National Insurance Fund (NIF), up to a maximum amount. After submitting the relevant form stating their claim, they will usually receive payment within 3-6 weeks if it is approved.

It’s not guaranteed employees will receive everything they are owed, but they can claim for redundancy, pay in lieu of notice, holiday pay, wages owed (up to 8-weeks) and any pension contributions that remain unpaid. It may also be possible to claim for unfair dismissal if the correct procedures are no followed when you are dismissed.

Further details on what happens to a company's employee's can be read in our guide to What happens to employees when a company enters liquidation.

How serious is a winding up order?

A winding up order is a serious matter for a company and its directors. Once the order has been made the company will no longer be able to carry on its business and its assets will be sold off to pay its creditors.

The company will also be struck off the Companies House register and its directors may be disqualified from being a company director for a period of time. This will be dependent on whether the liquidator's investigations find evidence that the director has breached their fiduciary duties such as continuing to trade whilst insolvent or mis-using Bounce Back Loan funds.

What are the advantages of compulsory winding up?

While compulsory liquidation can be a distressing experience for any business, there are still many benefits to taking this route of liquidation. Below is an overview of some key advantages:

- The process is overseen by a court-appointed official receiver who can ensure that the process is carried out correctly and fairly.

- The liquidation process can help to ensure that all creditors receive a fair share of any remaining assets.

- Once the liquidation process has been completed the company is dissolved. Company directors will cease to be liable for any of the outstanding company debts unless there were any personal guarantees or evidence of misconduct was found by the liquidator.

- The compulsory liquidation process can provide a fresh start for directors who wish to start a new company in the future.

- When an insolvent company is unable to finance the initial costs of a Creditors Voluntary Liquidation (CVL) and is not able to pay its creditors as and when they fall due, a compulsory liquidation may be their best option for resolution. The company will be closed following completion of the liquidator's duties and the directors are then free to move into new projects.

What are the disadvantages of compulsory winding up?

Whilst there are several advantages to a company facing winding up proceedings and compulsory liquidation, there are also several key disadvantages which include:

- The compulsory liquidation process can be time-consuming and expensive. Some complex liquidations can take several years to resolve.

- The liquidation process can be stressful for directors and employees, who will lose their jobs once a Winding up Order has been issued. They may face financial hardship as a result.

- Creditors may not receive full payment for debts owed, and in some cases, may receive nothing at all.

- Once a Winding up Order has been issued, the company's assets are frozen and cannot be used to pay creditors or continue trading.

- Directors may be investigated for potential wrongdoing leading up to the liquidation process and could be held liable for any debts or legal proceedings. For example, disposing of assets knowing the company is insolvent or through the mis-use of Bounce Back Loan funds.

- The process can damage the company's reputation and make it difficult for directors to start a new company in the future.

What are the differences between compulsory liquidation and voluntary liquidation?

While compulsory and voluntary liquidation are both routes to winding up a company, there are some key differences between the two processes. Here are some important distinctions to keep in mind:

- The voluntary process is initiated by the directors and shareholders whereas a compulsory liquidation is usually initiated by a creditor or government agency such as HM Revenue & Customs.

- A CVL gives the directors greater control over the process and can choose the liquidator who oversees the process. In compulsory liquidation, the court appoints an official receiver to oversee the process.

- A CVL provides the company directors with flexibility and control over when to initiate liquidation, while a compulsory liquidation is usually initiated by creditors through filing a winding up petition.

- Voluntary liquidation is a process that typically occurs when the company is solvent and can pay its debts but still wants to close operations. A company may also choose the voluntary process when insolvent which gives the directors control over appointing an insolvency practitioner as liquidator. A compulsory liquidation takes place when the business cannot meet its financial obligations and a creditor applies to the court for a winding up petition.

- In voluntary liquidation, the directors can potentially avoid legal action and personal liability if they follow the correct procedures. In compulsory liquidation, directors may face legal consequences and personal liability for company debts if they are found to have acted improperly leading up to the winding up order.

How does compulsory liquidation affect a director of the company?

Once a company enters compulsory liquidation, all of the director's powers are immediately revoked and authority is transferred to the liquidator. The responsibility for managing the company shifts from directors to cooperating with the liquidator and ensuring all requests for information are dealt with in a prompt timely manner.

The liquidator will assess the company's activities in the months that proceeded the Winding up Order and may bring legal action against directors if there is any proof of wrongful or fraudulent trading. Directors are obliged to provide the liquidator with any information and documents linked to the company’s funds and resources, etc. Directors can be held personally liable for some company creditors if any evidence of wrongdoing is discovered.

Therefore, it is important for directors to seek legal advice and take appropriate action to protect themselves and their interests during the compulsory liquidation process.

For more information on Wrongful and Fraudulent trading. Read our article What is Wrongful Trading? Does it affect me?

What order are creditors paid in a compulsory liquidation?

In a compulsory liquidation, creditors are paid out in a specific order of priority.

The first to be paid are secured creditors, who hold a charge or security over the company's assets. They will usually be able to recover the full amount of their debt from the sale of these assets. The costs of the compulsory liquidation such as the liquidator's fees are also paid.

Next in line are preferential creditors, who are owed certain types of debts such as employee wages and holiday pay, and certain taxes owed to HMRC. They are usually limited to a set amount in total, and any remaining debts are then paid to unsecured creditors.

Unsecured creditors are all those other creditors without any form of security over the company's assets, and they are typically the last to be paid. However, it is important to note that in many cases, unsecured creditors may not receive any payment at all if there are not enough assets to cover all of the company's debts.

For more information on the order of payment. Read our article Order of Payment of Creditors in Liquidation

How can a winding up order be stopped?

Facing a winding up order can be an alarming experience that will likely lead to the closure of a business and job losses for its employees. To prevent such an outcome from occurring in the first place, it is essential to understand your options as soon as possible. Here are some viable solutions you or your directors might consider:

- The company or its directors may be able to dispute the validity of the winding up petition or argue that there are other grounds for dismissing the petition such as if the creditor has not followed the correct processes.

- A company may be able to negotiate a payment plan with the creditor or creditors that have issued the winding up petition, potentially avoiding the need for a winding up order.

- The company may be able to secure financing from a third party to pay off its debts, either in full or in part.

- In some cases, it may be possible for the company to enter into a Company Voluntary Arrangement (CVA), which is a legal agreement between the company and its creditors that allows the company to continue trading while paying off its debts over time.

- If the winding up order has already been granted there may still be options for the company or its directors to challenge the order through an appeals process.

If you are the director of a limited company that has been served with a Winding up Petition and want to discuss your options and whether another solution is more practical to your needs such as a CVL or a Company Voluntary Arrangement (CVA), contact our insolvency experts here at Company Doctor today on 0113 237 9503 or request a call back through the web-form.

How Compulsory Liquidation Affects a Director of the Company

The consequences of having a company placed into compulsory liquidation can be significant for the directors of the company. This is especially true should it become evident through the process that they have been trading while the company was insolvent or engaging in other fraudulent activities. This can result in directors being held personally accountable for their debts.

Company directors may also face disqualification from acting as a director in the future depending on the circumstances surrounding the liquidation. This can be a serious blow to their career and financial prospects and can also have an impact on their personal reputation.

For more information, please read our article on Director Disqualification and the impact this can have if you are found to be serious breach of your fiduciary duties.

Summary

Compulsory liquidation is a formal insolvency procedure that is initiated through a winding up order from the court.

It is a serious process that is typically used by company creditors as a last resort when a company is unable to pay its debts. The process can be lengthy and complicated and primarily involves the sale of the company's assets to repay its creditors.

The compulsory liquidation process also has a significant impact on company employees who will lose their jobs. Employees will also have to liaise with the Redundancy Payment Service in relation to outstanding redundancy and remuneration.

However, there are some advantages to compulsory liquidation such as the ability to resolve disputes with creditors and start afresh. There are also several disadvantages, such as the loss of control for the company's directors and the impact on the company's reputation. It is important to understand the differences between compulsory and voluntary processes of liquidation, as well as the consequences of each.

If faced with a winding up petition or statutory demand, seeking professional advice and taking action as soon as possible can help to minimize the risks and protect the company's interests.

How can Company Doctor help you?

Here at Company Doctor, we have our own licensed insolvency practitioner and team of insolvency experts with decades of experience. Contact us today on 0113 237 9503 for a free no obligation chat on your options if you are worried about or have already been served with a Winding up Petition.

We can discuss all the options to suit your circumstances whether that be to take control of the situation through a CVL or whether the petition can be dismissed and the company saved.

References

The primary sources for this article are listed below.

https://www.gov.uk/government/organisations/companies-house

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.

FAQs

In compulsory liquidation, the operation of the business ceases, the directors are relieved of their responsibilities and authority and the assets of the business will be sold in order to repay creditors. Ultimately, the company is removed from the register at Companies House and ceases to exist.

The expenses of the liquidator will be paid as a priority in the winding-up proceedings, following secured creditors with a fixed charge. Furthermore, it is the responsibility of the liquidator to investigate the actions of the directors, ensuring that no improper conduct has occurred that could have negatively affected the amount owed to the company's creditors.

- The business is unable to meet its financial obligations on time.

- Its debts surpass its total assets.

- The business is experiencing continual losses, with limited prospects for recovery.

- The directors are struggling to handle the overwhelming stress and pressure associated with ongoing trading.

The process of compulsory liquidation commences when a creditor delivers a statutory demand, allowing you 21 days to make payment or 18 days to challenge the demand. Failure to comply with the demand or dispute it gives the creditor the right to seek a winding-up hearing from the court.

What you Need to Know If You Receive a Winding Up Petition from HMRC →

In the event of a Limited company going into Liquidation, there is a possibility that the Director may face the risk of losing their home. However, this is not likely to occur directly unless there is evidence of misconduct or a demand made against a personal guarantee.

Further Reading On Liquidation Related Matters

- How Does Liquidation Affect You Personally?

- What Happens To Employees When A Company Enters Liquidation?

- What To Expect In A Company Investigation During Liquidation

- The Compulsory Liquidation Process

- Company Liquidation Explained – A Helpful Guide

- A Guide To Applying For A Creditors Voluntary Liquidation

Get Help

For immediate FREE advice and guidance contact us via this online form to find out how we can help your business.

Our Services

Company Liquidation

Our licensed insolvency practitioners will guide you to the right solution, whatever your financial situation may be.

Cant Repay Bounce Back Loan or CBILS

Contact us for advice if you are unable to repay funding received, including Furlough, CBILS, CLBILS, BBLS and (SEISS).

Company Dissolution

Company dissolution (striking off), is the process of shutting down a limited company.

Winding Up Petitions

We can help if your business may be put into compulsory liquidation, or you have received a winding up petition.

Time To Pay Arrangement

We can find the best solutions and negotiate Time To Pay Arrangements on your behalf.

Directors Redundancy Claims

Did you know that many company directors are entitled to redundancy payments if the company is liquidated?

What Our Customers Are Saying