Creditors Voluntary Liquidation

What is a Creditors Voluntary Liquidation (CVL)?

A creditor voluntary liquidation (CVL) is a process by which an insolvent limited company is wound up voluntarily because it cannot pay its debts as they fall due. For directors wishing to liquidate a solvent company, they can choose to enter into a Members Voluntary Liquidation.

A CVL is initiated by the directors and shareholders, who must pass a resolution to voluntarily wind up the insolvent company. The formal insolvency procedure is overseen by a licensed insolvency practitioner who will act as the liquidator.

What will trigger a Creditors Voluntary Liquidation?

A CVL is typically triggered when a company is facing financial difficulties and cannot pay its debts as they fall due.

There are various reasons a business could be faced with this scenario but the most common ones are the loss of a major customer or supplier or non payment of a large debt. Also, increased competition within your industry or a decline in the market for your products or services.

For a company that is facing compulsory liquidation action from a winding up petition issued by one of its creditors, a CVL can be a better alternative to directors as they have control over who is appointed as the liquidator and when the liquidation happens.

If you are the director of a struggling business and want to discuss your company liquidation options, please call us at Company Doctor today on 0113 237 9503.

Who pays for Creditors Voluntary Liquidation?

The costs of a CVL are typically paid for by the company's assets.

If there are no assets or the value of the assets are uncertain, the directors will likely be required to pay an initial up front fee to the insolvency practitioner for the liquidation to proceed.

Please read our article on liquidating a company with no money if you are concerned about covering the costs involved.

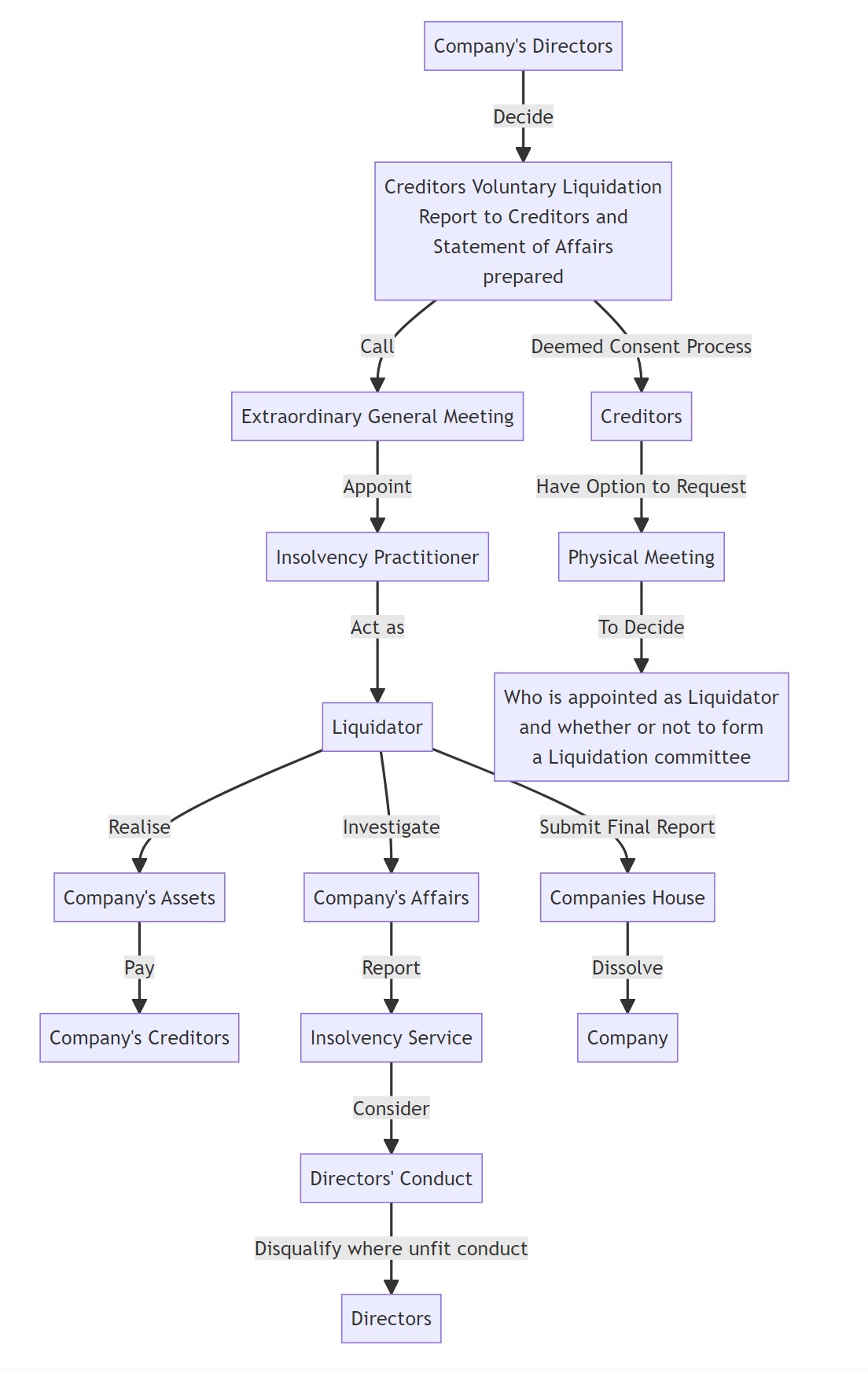

CVL Process

Can you just dissolve a company if you have outstanding liabilities?

No, you cannot dissolve a company if you have outstanding liabilities. Directors could be held personally liable for company debts if they attempt to dissolve a company that has outstanding debts.

This is particularly prominent at the moment as many companies are attempting to strike off with an outstanding bounce back loan. HMRC and the government are clamping down on this and any attempt to strike off with outstanding debts owed to HMRC or a bounce back loan will almost certainly be objected to.

Read our guide if you are unable to repay your Bounce Back Loan.

Who initiates a Creditors Voluntary Liquidation?

A CVL is initiated by the company's directors and shareholders, who must pass a special resolution to voluntarily wind up the insolvent company.

What role does the licensed Insolvency Practitioner (IP) have?

An authorised insolvency practitioner is appointed by the shareholders of a company to act as liquidator.

Following their appointment they will primarily be responsible for the sale of the company's assets with the funds raised used to pay the company's creditors. Any remaining surplus funds will then be paid to shareholders.

The liquidator is also responsible for all statutory duties including reporting to company creditors and Companies House and investigating the current affairs and financial position of the company and the conduct of directors to ensure they have complied with their fiduciary duties.

Please read our article for more details on the selection of an insolvency practitioner and what role they have in a company liquidation.

How long does a Creditors Voluntary Liquidation take?

The time it takes for a CVL to be completed varies depending on the intricacy and size of the company. Generally, this process can take anywhere from three months up to one year.

The licensed insolvency practitioner will conduct a comprehensive review of the company's finances, which they will then detail in their reports to creditors and Companies House. The liquidator has authority to dispose of any remaining business assets and allocate the surplus proceeds among creditors – notifying each affected party along the way.

It's important to note that the process can take longer if there are any outstanding legal disputes, such as legal challenges to the validity of the liquidation or claims against the company. In such cases, the IP will work to resolve these issues before the liquidation can be concluded.

What are the consequences of a Creditors Voluntary Liquidation?

Entering into a voluntary liquidation is not a decision that should be made lightly. Directors should consider all the key consequences of the process before committing to the CVL. The main points to consider are:

- The company will cease to exist once the liquidation process has been completed and the details have been removed from the register of companies

- Once a licensed insolvency practitioner has been appointed, the directors control of the company's affairs will end and the IP will take over the company's dealings

- The assets of the business will be sold with the funds distributed amongst the company's creditors. Any surplus funds that remain will be distributed to the shareholders of the business

- Any remaining debts will be written off once the liquidation has completed. However, if the director has signed a personal guarantee for any of the debts then they will remain liable for the outstanding balance

- The directors may face legal action if they are found to have breached their duties, such as trading whilst insolvent (wrongful trading) or failing to keep adequate financial records

What are the Pros and Cons of Creditors Voluntary Liquidation?

A CVL can provide directors with a viable path to closing their business in a legal and orderly way. There are several pros and cons of utilising this option and we will discuss the main advantages and disadvantages below

Pros:

- Controlled process: By opting for a CVL, directors can retain some control over the process of winding up the company. They can choose the insolvency practitioner who will oversee the process and have some input into the order in which creditors are paid.

- Reduced personal liability: Once the company enters into a CVL, the directors’ personal liability for the company’s debts will generally be limited. However, directors should be aware that if they have been found to have acted fraudulently or in breach of their duties, they may still be held personally liable for some or all of the company’s debts.

- Fresh start: For directors who have been struggling to keep the company afloat, a CVL can offer a chance to start again. They can either purchase the assets from the iquidator at market value and start again, or walk away from the business with a clean slate, knowing that all outstanding company debts and liabilities will be dealt with through the formal liquidation process.

- Less stress: The stress of dealing with mounting debts and creditors can be overwhelming for directors. Entering into a CVL can bring a sense of relief, as the burden of dealing with creditors is taken on by the insolvency practitioner.

Cons:

- Loss of control: While directors do have some input into the Creditors Voluntary Liquidation process, ultimately control will pass to the insolvency practitioner. They will oversee the sale of the company assets, the repayment of creditors and the winding up of the company. Directors will no longer have a say in how the business is run.

- Damage to reputation: Entering into a CVL can damage a company’s reputation, particularly if it is widely reported in the media. Suppliers and customers may be less likely to do business with a company that has entered into liquidation.

- Loss of assets: Any assets held by the company will be sold off as part of the liquidation process, with the proceeds used to repay creditors. This can mean that directors lose control of assets they have worked hard to acquire.

- Cost: While Creditors Voluntary Liquidation can offer a relatively cost-effective way of winding up a company, there will still be costs involved. These will include fees payable to the insolvency practitioner, as well as any legal fees associated with the process.

It's important for directors to weigh up the pros and cons of voluntary company liquidation before making a decision, and to seek professional advice if necessary.

Check out our article on The pros and cons of company liquidation: What you need to know for further information.

What Documents are Required for for a CVL?

To initiate the Creditors Voluntary Liquidation process the insolvency practitioner will help the directors prepare a range of documents including:

- A board resolution: At a board meeting, directors present their decision to wind up the company and appoint an insolvency practitioner of their choice as liquidator.

- A Statement of Affairs: This shows an overview of the company’s financial standing by listing the book value and estimated realisable value of assets, liabilities, and a list of creditors along with their respective contact information.

- Report to Creditors: This provides a brief history of the company, statutory information, a summary of the last 3 years accounts and the current statement of affairs and the likelihood of a dividend to creditors.

- Shareholders and creditors meetings: The requisite notices and formalities for passing shareholder resolutions and obtaining consent from creditors to the appointment of the nominated insolvency practitioner must be strictly complied with.

- Notice of appointment: This will be provided to all interested parties including Companies House and creditors once the insolvency practitioner has been appointed as liquidator of the company.

What happens to outstanding creditors in liquidation?

The appointed insolvency practitioner will be responsible for dealing with all outstanding creditors throughout the liquidation process, as well as distributing all available company assets as per a designated order of priority depending on the class each creditor falls into. Creditors will be paid in the following order:

- Secured creditors with a fixed charge – This include banks and asset-based lenders who are holding a fixed charge over a business asset such as property, machinery, or vehicles.

- Preferential creditors – Employees who are owed arrears of wages and holiday pay are classed as preferential creditors, and they will receive a distribution once fixed charge creditors holding security have been paid.

- Secondary preferential creditors – Since December 2020, VAT and PAYE debts owed by a company have been elevated to secondary preferential status.

- Secured creditors with a floating charge – Floating charge holders are those who hold security over moveable assets such as stock, raw materials, as well as fixtures and fittings in commercial premises.

- Unsecured creditors – Trade creditors comprise those who have lent to the business, or extended a line of credit, yet have not had this secured by an asset. A large number of creditors typically fall into this category including trade creditors, and unsecured finance agreements such as loans and credit cards. In many CVLs, unsecured creditors typically receive a minimal distribution, or may be left out of pocket altogether.

- Shareholders – Shareholders are the final group to get paid and will only receive a distribution if all other creditors have been paid in full. In the case of a CVL, there will not be surplus funds remaining at this stage to give shareholders a distribution.

It's important to note that shareholders are only entitled to a distribution of funds once all creditors have been paid in full.

Does liquidating a company affect you personally?

Liquidating a company does not necessarily affect the directors personally, provided they have acted in accordance with their legal duties and obligations.

However, if the directors are found to have breached their duties, they can expect the liquidator to file an adverse report which could see them face further action ranging from being disqualified from being a director through to facing legal proceedings.

What are the final steps of a CVL?

After the liquidator has successfully sold all of the assets owned by the company and distributed the proceeds among its creditors, they will begin preparation of the final account.

The final steps of the CVL involve the liquidator winding up the company, realising its assets and preparing a final report on acts and dealings during the liquidation to creditors and a final account to Companies House.

Following submission of the liquidator's final report, the company will be officially dissolved. The company will cease to exist as a legal entity and will be removed from the Companies Register. The responsibilities of the directors and shareholders will end at this point unless any director has any personal guarantees on any outstanding liabilities.

What happens if a company I owe money to goes into liquidation?

Once a company enters liquidation, any creditors owed money will be contacted by the liquidator with a report on the financial position of the business. The report will provide details of the remaining assets and all other liabilities and will provide details on how you can submit your claim to the liquidator and any supporting evidence required.

Once the assets have been sold, the liquidator will distribute the funds based on the hierarchy of creditors discussed earlier. If you are an unsecured creditor, it is highly likely that you will not get back the full amount that you are owed.

The end of the liquidation does not necessarily mean that all is lost if you are still owed money from the former company. Any creditor that holds a personal guarantee that was signed by any of the directors can pursue the remaining balance owed directly from the director(s) who remain personally liable for the remaining balance.

For more information read our article on What is a CVL and What is the CVL Cost?

Summary

A CVL is an important process for struggling companies that can no longer pay their debts. It allows a company to be wound up in a legal and orderly manner with the aim of ensuring that all creditors are treated fairly and that the funds from the sale of assets are distributed as quickly as possible.

While liquidation can be a difficult and emotional decision, it can also provide a fresh start for business owners and allow them to move on from a difficult situation. It's important to seek professional advice before making a decision about company liquidation, and to stay informed throughout the process.

We hope this guide to CVLs has been helpful in providing an overview of the process and answering some of the most common questions. Every situation is unique and it's important to seek professional advice from an insolvency practitioner before making any decisions about voluntary liquidation.

Here at Company Doctor, we have our own licenced insolvency practitioner and a team of insolvency experts with decades of experience. If you are the director of a business that is struggling to pay its debts and want to discuss your liquidation options, please complete the web form or call us today on 0113 237 9503 or on freephone 0800 169 1536.

References

The primary sources for this article are listed below.

https://www.ukliquidators.org.uk/company-liquidation

https://www.gov.uk/government/organisations/companies-house

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.

FAQs

As implied by its name, a Creditors' Voluntary Liquidation represents a voluntary method of putting an insolvent company into liquidation. This action is typically initiated by the directors or shareholders when they realise that the financial difficulties of their company have escalated beyond the potential for recovery.

As a company goes into liquidation, its assets are liquidated by the appointed liquidator to raise funds for creditors. After all creditors have been compensated to the extent that the funds permit, any outstanding debts are written off.

In terms of Creditors' Voluntary Liquidations, the procedure to put the company into a CVL can be accomplished in as short as 14 days. However, the completion of the liquidation typically spans between 6 to 24 months, dependent on the company's size and specific conditions.

The director has the responsibility for paying the fees for the liquidation, although frequently these can be paid from the assets of the company. A lot of directors also hold the status of employees within the company and receive salary in payment for work undertaken.

Typically, secured creditors hold the highest precedence, succeeded by priority unsecured creditors. Before equity shareholders are considered, any other creditors are settled first.

Get Help

For immediate FREE advice and guidance contact us via this online form to find out how we can help your business.

Our Services

Company Liquidation

Our licensed insolvency practitioners will guide you to the right solution, whatever your financial situation may be.

Cant Repay Bounce Back Loan or CBILS

Contact us for advice if you are unable to repay funding received, including Furlough, CBILS, CLBILS, BBLS and (SEISS).

Company Dissolution

Company dissolution (striking off), is the process of shutting down a limited company.

Winding Up Petitions

We can help if your business may be put into compulsory liquidation, or you have received a winding up petition.

Time To Pay Arrangement

We can find the best solutions and negotiate Time To Pay Arrangements on your behalf.

Directors Redundancy Claims

Did you know that many company directors are entitled to redundancy payments if the company is liquidated?

What Our Customers Are Saying