Cash flow forecasting is like a crystal ball for businesses. It’s the secret sauce that helps predict and plan for their financial future. But why is it so important? Well, accurate cash flow projections can make or break a company’s success. They provide vital insights into the timing of cash inflows and outflows, allowing businesses to anticipate potential gaps or surpluses in funds.

By analysing historical cash flow data and using tools like cashflow templates, companies gain a clearer understanding of their cash position. This empowers them to make informed decisions about everything from investments to day-to-day expenses. With effective cash flow management, organizations can avoid pitfalls, seize opportunities, and navigate uncertain times with confidence.

So whether you’re running a small start-up or managing a multinational corporation, mastering the art of cash flow forecasting is crucial for staying ahead in today’s dynamic business landscape. It’s time to unlock the power of your financial crystal ball!

- Importance and Benefits of Cash Flow Forecasting:

- Step-by-Step Guide on Creating a Cash Flow Forecast:

- Selecting the Best Forecasting Method for Your Business:

- Choosing the Right Forecasting Period for Cash Flow

- Tracking Income and Expenses for Accurate Forecasts:

- Streamlining Cash Flow Forecasting with Automation Tools:

- Reviewing Estimated vs. Actual Cash Flows: Expense Compilation

- Conclusion: The Power of Effective Cash Flow Forecasting

- References

- FAQs

- How often should I update my cash flow forecast?

- Can I use historical data for creating a cash flow forecast?

- What are the benefits of using automation tools for cash flow forecasting?

- How can accurate cash flow forecasting support business growth?

- Should I seek professional assistance for cash flow forecasting?

Importance and Benefits of Cash Flow Forecasting:

Cash flow forecasting is a crucial aspect of financial planning for any business. By accurately predicting the inflows and outflows of cash, businesses can avoid cash shortages, ensure financial stability, and make informed decisions based on projected cash flows.

Avoiding cash shortages and ensuring financial stability

One of the primary benefits of cash flow forecasting is its ability to help businesses avoid cash shortages. By analysing past trends and future projections, businesses can identify periods when they may experience a shortfall in funds. This allows them to take proactive measures such as securing additional financing or adjusting their expenses to ensure they have enough liquidity to cover their obligations.

Furthermore, by having a clear picture of their expected cash inflows and outflows, businesses can maintain financial stability. They can plan ahead for major expenses or investments, ensuring they have sufficient funds available when needed. This helps prevent situations where businesses are caught off guard by unexpected costs or unable to meet their financial commitments.

Identifying potential funding gaps or excess cash reserves

Cash flow forecasting also enables businesses to identify potential funding gaps or excess cash reserves. By comparing projected future cash flows with their anticipated needs, businesses can determine if they will require additional financing to support their operations or growth plans. This early identification allows them to explore various funding options such as loans, lines of credit, or equity investments well in advance.

Conversely, accurate cash flow forecasting helps prevent excessive accumulation of idle funds that could be put to better use elsewhere. It enables businesses to optimize their working capital management by identifying opportunities for investment or debt reduction. For example, if a company consistently forecasts excess cash reserves during certain periods, they may consider investing those funds in short-term instruments like treasury bills or using them to pay down high-interest debts.

Making informed business decisions based on projected cash flows

Another significant advantage of cash flow forecasting is the ability it provides businesses to make well-informed decisions. By having a clear understanding of their future cash position, businesses can evaluate the financial implications of various strategic choices.

For instance, if a business is considering expanding its operations or launching a new product line, cash flow forecasting helps assess whether they have the necessary funds to support these initiatives. It allows them to determine if additional financing will be required and if the expected returns justify the investment.

Moreover, cash flow forecasting aids in setting realistic budgets and targets for sales and marketing efforts. Businesses can align their expectations with their projected cash inflows, ensuring that they allocate resources effectively and avoid overextending themselves financially.

Step-by-Step Guide on Creating a Cash Flow Forecast:

Gathering historical financial data for analysis

To create an accurate cash flow forecast, the first step is to gather historical financial data for analysis. This includes examining past income statements, balance sheets, and cash flow statements. By reviewing these documents, you can identify trends in your company’s cash inflows and outflows over time.

Take note of any seasonal fluctuations or patterns that may impact your cash flow. For example, if you run a retail business, you may notice increased sales during the holiday season or slower months during the summer. Understanding these trends will help you make more accurate predictions for future cash flows.

Estimating future sales and revenue streams

The next step in creating a cash flow forecast is estimating future sales and revenue streams. This involves analysing market conditions, customer behavior, and industry trends to make informed projections.

Consider factors such as changes in consumer demand, new product launches, or shifts in your target market. Take into account any upcoming contracts or agreements that may impact your revenue. By conducting thorough research and analysis, you can develop realistic estimates for your future sales.

It’s important to be conservative when making these projections to avoid overestimating your revenue. While it’s tempting to be optimistic about future growth, it’s better to err on the side of caution to ensure accuracy in your forecast.

Projecting expenses and identifying areas for cost reduction

Once you have estimated your revenue streams, it’s time to project expenses and identify areas for cost reduction. Start by reviewing your past expenses and categorizing them into fixed costs (e.g., rent) and variable costs (e.g., raw materials).

Consider any upcoming investments or expenditures that may impact your cash flow. For example, if you plan on purchasing new equipment or expanding your operations, factor in the associated costs.

Identify areas where you can potentially reduce costs without compromising the quality of your products or services. This could involve renegotiating contracts with suppliers, optimizing your procurement process, or finding more cost-effective alternatives.

By carefully analysing your expenses and exploring opportunities for cost reduction, you can create a cash flow forecast that reflects your company’s financial reality.

Example:

Here’s an example of how the cash flow forecasting process can be applied in practice:

- Gather historical financial data: Review the past three years’ income statements, balance sheets, and cash flow statements to identify patterns and trends.

- Estimate future sales: Analyse market research, industry reports, and customer behavior to project future sales growth. Take into account any factors that may impact demand for your products or services.

- Project expenses: Categorize your expenses into fixed and variable costs. Consider any upcoming investments or expenditures that may affect your cash flow.

- Identify areas for cost reduction: Evaluate your procurement process to find ways to reduce costs without sacrificing quality. Negotiate contracts with suppliers to secure better pricing terms.

- Create a cash flow forecast: Combine the estimated revenue streams with projected expenses to create a comprehensive cash flow forecast for the next 12 months.

By following these steps and regularly updating your forecast based on actual results, you can gain valuable insights into your company’s financial health and make informed decisions to improve cash flow management.

Selecting the Best Forecasting Method for Your Business:

Cash flow forecasting is a crucial aspect of financial planning for businesses. It allows business leaders to anticipate and manage their cash inflows and outflows effectively, enabling them to make informed decisions about strategic sourcing, vendor management, and procurement. Selecting the best method for your business is essential.

Understanding Different Forecasting Methods

There are various methods available for cash flow forecasting, including direct, indirect, or hybrid approaches. Each method has its own advantages and disadvantages, so understanding them is vital in making an informed decision.

- Direct Forecasting:

- This method relies on historical data and uses past performance as a basis for predicting future cash flows.

- It involves analysing information such as sales records, accounts receivable/payable data, and inventory levels.

- Direct forecasting is beneficial for businesses with stable operations and consistent patterns.

- Indirect Forecasting:

- Unlike direct forecasting, indirect forecasting utilizes external factors or indicators to predict cash flows.

- Economic trends, industry benchmarks, market research data, or even changes in customer behaviour can be considered in this method.

- Indirect forecasting suits businesses operating in dynamic industries where internal historical data may not provide accurate predictions.

- Hybrid Forecasting:

- As the name suggests, hybrid forecasting combines elements of both direct and indirect methods.

- It leverages internal data while also considering external factors to enhance accuracy.

- This approach offers flexibility by incorporating multiple sources of information into the forecast model.

Considering Factors for Selection

To select the best forecasting method for your business’s cash flow needs, several factors should be taken into account:

- Industry Type:

- Consider whether your industry experiences regular fluctuations or operates within a stable environment.

- Dynamic industries may benefit from indirect forecasting, while stable sectors could rely on direct methods.

- Business Size:

- The size of your business can influence the availability of resources and data needed for accurate forecasts.

- Smaller businesses might find direct forecasting more manageable due to limited historical information.

- Available Resources:

- Evaluate the resources at your disposal, such as financial software, analytical tools, or personnel expertise.

- Some forecasting methods may require advanced technology or specialized knowledge.

- Pros and Cons Evaluation:

- Assess the advantages and disadvantages of each method based on your business’s specific requirements.

- Consider factors like accuracy, ease of implementation, time commitment, and adaptability to change.

By carefully evaluating these factors, you can determine which cash flow forecasting method aligns best with your business’s needs and goals. Remember that there is no one-size-fits-all solution; what works for one company may not work for another. Therefore, it is crucial to analyse your unique circumstances thoroughly.

Choosing the Right Forecasting Period for Cash Flow

Determining the appropriate time frame for cash flow forecasting is crucial for businesses to effectively manage their finances. The chosen period, whether it be daily, weekly, or monthly, should align with the specific needs of the business. Let’s explore some key considerations when selecting the right forecasting period.

Balancing Accuracy and Practicality

When deciding on a forecasting period, it is essential to strike a balance between accuracy and practicality. While shorter periods provide more precise insights into cash flow fluctuations, they also demand greater efforts in data collection and analysis. Conversely, longer periods may offer convenience but can compromise accuracy due to potential unforeseen circumstances.

To illustrate this point further, let’s consider an example:

- Daily Forecasting: This approach allows businesses to closely monitor their cash flow on a day-to-day basis. It provides real-time insights into revenue generation and expenditure patterns. However, the level of detail required for daily forecasting can be time-consuming and resource-intensive.

- Weekly Forecasting: Opting for a weekly forecasting period strikes a balance between accuracy and practicality. It allows businesses to capture broader trends without overwhelming them with excessive data points. This timeframe facilitates better planning while still providing timely updates on cash flow status.

- Monthly Forecasting: A monthly forecasting period offers a high-level overview of cash flow trends over an extended duration. It is particularly useful for long-term financial planning and identifying seasonal patterns in revenue and expenses. Monthly forecasts are generally less burdensome in terms of data collection efforts compared to shorter periods.

Adapting Forecast Periods as Circumstances Change

Business circumstances are dynamic, constantly evolving with market conditions or operational changes. Therefore, it is important to remain flexible in adjusting forecast periods accordingly.

Here are some scenarios where adapting forecast periods becomes necessary:

- Seasonal Variations: Businesses experiencing significant seasonal fluctuations may require more frequent forecasts during peak seasons and less frequent ones during slower periods.

- Rapid Growth or Expansion: If a business is rapidly growing or expanding, shorter forecast periods may be necessary to closely monitor cash flow changes and ensure sufficient liquidity.

- Economic Uncertainty: During times of economic uncertainty, such as recessions or market downturns, businesses may opt for shorter forecasting periods to maintain a tighter grip on their financials and react swiftly to any adverse changes. This can help ensure the business remains solvent and avoids running out of cash and putting the business at risk if entering into liquidation.

Tracking Income and Expenses for Accurate Forecasts:

Accurately forecasting cash flow is crucial for businesses to effectively plan their financial strategies. By tracking income and expenses, businesses can gain valuable insights into their financial health and make informed decisions about future investments and expenditures.

Implementing effective bookkeeping practices to record all income sources accurately

In order to forecast cash flow accurately, it is essential for businesses to have a comprehensive understanding of their income sources. Implementing effective bookkeeping practices ensures that all revenue streams are recorded accurately, providing a clear picture of the business’s financial status.

One way to achieve accurate income tracking is by regularly reconciling sales receipts with sales forecasts. By comparing actual sales income against projected figures, businesses can identify any discrepancies and adjust their forecasts accordingly. This allows them to make more accurate predictions about future cash inflows.

Another important aspect of tracking income is maintaining detailed records of invoices and payments received. Timely recording of these transactions helps in identifying any outstanding payments or delayed invoicing, which may impact cash flow projections. By staying on top of accounts receivable, businesses can ensure a steady stream of incoming funds.

Categorizing expenses properly to identify trends and patterns over time

Categorizing expenses correctly plays a vital role in understanding spending patterns and trends within a business. It enables businesses to allocate resources effectively while identifying areas where cost-cutting measures can be implemented.

By organizing expenses into categories such as salaries, utilities, inventory management, marketing, or financing activities, businesses can analyse expenditure patterns over time. This analysis provides insights into areas where costs might be escalating or opportunities for optimizing spending arise.

Moreover, proper expense categorization facilitates the identification of fixed versus variable costs. Fixed costs remain constant regardless of business activity levels (e.g., rent), while variable costs fluctuate with sales or production volume (e.g., raw materials). Understanding these distinctions helps businesses make more accurate forecasts, especially.

Utilizing accounting software or spreadsheets to streamline tracking processes

To simplify the tracking of income and expenses, businesses can leverage accounting software or spreadsheets. These tools automate calculations, reduce human error, and provide real-time visibility into financial statements.

Accounting software offers a range of features that facilitate cash flow forecasting. It allows for seamless integration of income and expense data, generating instant reports such as income statements and balance sheets. With the ability to customize reports based on specific requirements, businesses can easily track net income trends and identify areas for improvement.

Alternatively, spreadsheets like Microsoft Excel provide a flexible solution for smaller businesses. They allow users to create customizable templates tailored to their unique needs. By inputting sales receipts, invoices, and expenses into organized spreadsheets, businesses can generate comprehensive financial overviews that aid in accurate forecasting.

Streamlining Cash Flow Forecasting with Automation Tools:

Cash flow forecasting is a crucial aspect of managing finances for businesses of all sizes. It allows organizations to predict and plan their future cash inflows and outflows, ensuring they have enough liquidity to meet their financial obligations. However, manual cash flow forecasting can be time-consuming and prone to human error. That’s where automation tools come in, revolutionizing the way businesses handle this critical process.

Simplifying data entry through integration with accounting systems or bank feeds

One of the key benefits of using automation tools for cash flow forecasting is the ability to simplify data entry. These tools can integrate seamlessly with your existing accounting systems or directly connect with your bank feeds, eliminating the need for manual data input. By automatically pulling in transactional data from these sources, you save valuable time and reduce the risk of errors that can occur during manual entry.

Automating calculations to save time and reduce human error

Automation tools take care of complex calculations involved in cash flow forecasting, saving you considerable time and effort. These tools can perform intricate calculations such as projecting future revenue based on historical trends, estimating expenses, factoring in payment terms, and considering other variables that impact your cash flow. By automating these calculations, you not only streamline the process but also minimize the chances of human error.

Creating customizable reports that provide real-time insights into cash flow

Another significant advantage of using automation tools for cash flow forecasting is the ability to generate customizable reports that offer real-time insights into your financial health. These reports can be tailored to suit your specific needs and preferences, providing a comprehensive overview of your projected cash inflows and outflows over different time periods. With access to up-to-date information at your fingertips, you gain better visibility into potential liquidity gaps or surplus funds.

Automation tools enable businesses to optimize their supply chain finance by streamlining processes related to supplier information management (SIM), reverse factoring, early payment discounts, and more. By automating these processes, organizations can enhance their supplier relationship management and strengthen their supply chain partnerships.

In addition to the benefits mentioned above, automation tools also offer features such as AP automation, virtual cards for payments, VAT calculations, and customizable templates for cash flow forecasting. These features further simplify the process by reducing manual intervention and providing standardized formats that ensure consistency in reporting.

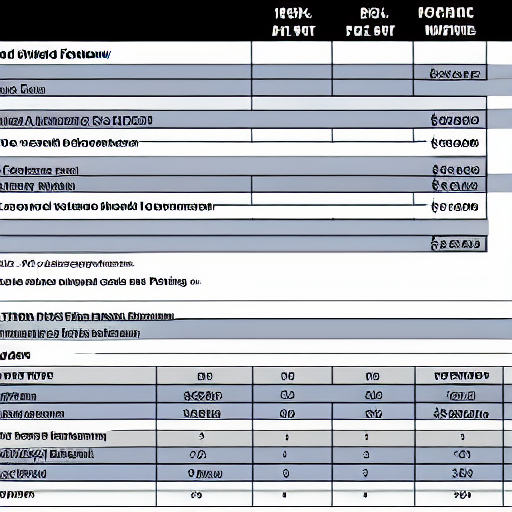

Reviewing Estimated vs. Actual Cash Flows: Expense Compilation

Analysing variances between projected and actual income/expenditures is a crucial step in cash flow forecasting. By comparing the estimated cash flows with the actual figures, businesses can gain valuable insights into their financial performance and make informed decisions for the future.

When reviewing the actual cash inflows and outflows, it is essential to identify any significant discrepancies. This analysis helps determine whether the initial projections were accurate or if adjustments are necessary. By understanding the reasons behind these variances, businesses can improve their forecast accuracy and make more reliable predictions.

One of the key benefits of reviewing estimated versus actual cash flows is identifying areas where adjustments or corrective actions may be necessary. For example, if expenses consistently exceed projections, it could indicate inefficiencies in cost management or unexpected increases in operating costs. By recognizing these patterns, businesses can take proactive measures to address them promptly.

To delve deeper into this analysis, it’s important to break down different expense categories and compare them against estimates. This allows businesses to pinpoint specific areas that contribute most significantly to deviations from projections. For instance, examining payroll expenses might reveal unexpected overtime costs or higher-than-anticipated salaries due to staff turnover.

In addition to identifying discrepancies, reviewing estimated versus actual cash flows provides an opportunity for reflection on business strategies and decision-making processes. It prompts questions such as:

- Did external factors impact revenue generation?

- Were there unforeseen market changes that affected sales?

- Did pricing strategies align with customer demand?

- Were there any unexpected capital expenditures?

Answering these questions helps businesses gain a better understanding of their operations and market dynamics while providing insights for future planning.

Moreover, this review process enables businesses to assess their forecasting methods’ effectiveness accurately. If discrepancies occur consistently across multiple expense categories over several periods, it suggests a need for reassessing forecasting techniques or considering external factors that may influence financial outcomes.

To illustrate the significance of reviewing estimated versus actual cash flows, consider a scenario where a manufacturing company projected lower material costs due to anticipated discounts from suppliers. However, the actual expenses turned out to be significantly higher because the expected discounts did not materialize. By closely examining this variance, the company can take corrective actions such as renegotiating contracts with suppliers or seeking alternative sourcing options.

Conclusion: The Power of Effective Cash Flow Forecasting

Cash flow forecasting is a vital tool for businesses to manage their finances effectively. By accurately predicting the inflows and outflows of cash, organizations can make informed decisions, plan for the future, and ensure financial stability.

Throughout this guide, we have explored the importance and benefits of cash flow forecasting. We discussed the step-by-step process of creating a cash flow forecast, including selecting the best forecasting method and determining the appropriate time period for analysis. Tracking income and expenses diligently is crucial in achieving accurate forecasts.

Automation tools play a significant role in streamlining cash flow forecasting processes, saving time and minimizing errors. Leveraging these tools can enhance efficiency and provide real-time insights into your business’s financial health.

Reviewing estimated versus actual cash flows allows you to identify any discrepancies or areas that require adjustment. This practice helps refine your forecasts over time, making them more accurate and reliable.

In summary, effective cash flow forecasting empowers businesses by providing valuable insights into their financial position. It enables proactive decision-making, ensures sufficient liquidity, aids in managing expenses efficiently, and supports growth strategies.

To maximize the benefits of cash flow forecasting:

- Regularly update your forecasts to reflect changing circumstances.

- Utilize automation tools to streamline the process.

- Review estimated versus actual cash flows regularly.

- Seek professional advice or guidance if needed.

By implementing these practices consistently, you can gain greater control over your finances while positioning your business for success.

If you are the director of a struggling business and would like advice on your options, contact one of our professional advisors here at Company Doctor for a no obligation chat about your circumstances.

References

The primary sources for this article are listed below.

https://www.british-business-bank.co.uk/finance-hub/how-to-create-a-cash-flow-forecast-in-4-steps/

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.

Freephone including all mobiles

FAQs

How often should I update my cash flow forecast?

Updating your cash flow forecast depends on various factors such as business volatility or changes in market conditions. However, it is recommended to review and update your forecast at least monthly to ensure accuracy.

Can I use historical data for creating a cash flow forecast?

Yes! Historical data provides valuable insights into past trends and patterns that can help inform your cash flow forecast. However, it is essential to consider any changes or unique circumstances that may impact future cash flows.

What are the benefits of using automation tools for cash flow forecasting?

Automation tools can streamline the forecasting process by automating data entry, performing calculations, and generating reports. This saves time and reduces the risk of errors, allowing you to focus on analysing the results and making informed financial decisions.

How can accurate cash flow forecasting support business growth?

Accurate cash flow forecasting enables you to identify potential funding gaps or excess liquidity, allowing you to plan and allocate resources effectively. This helps ensure sufficient funds are available for growth initiatives while minimizing the risk of financial instability.

Should I seek professional assistance for cash flow forecasting?

If you are uncertain about creating a cash flow forecast or require more advanced analysis, seeking professional assistance from accountants or financial advisors can provide valuable expertise and guidance tailored to your specific business needs.