Members Voluntary Liquidation MVL Help & Advice

A solvent company may formally wind itself up through a process known as a Members' Voluntary Liquidation (MVL). When a company's directors decide they no longer want to trade, retire, or want to restructure the business, they often start this process. Companies and their directors can gain a lot from an MVL, including tax savings, better control, and a more effective winding-up process.

The procedure for an MVL is quite intricate and needs to abide by established legal guidelines. As a result, it requires thoughtful planning and specialist help from experts. In this article, we will provide a comprehensive guide to the Members' Voluntary Liquidation process its benefits and drawbacks and the key factors to consider when deciding whether to proceed with the solution.

What is Members' Voluntary Liquidation MVL?

For solvent companies seeking to close, a Members' Voluntary Liquidation (MVL) presents a convenient and advantageous legal process for distributing company assets. Not only does the MVL provide an efficient solution but it also enables eligible individuals to take advantage of Business Asset Disposal Relief (formerly known as “entrepreneur’s relief”) resulting in substantial tax savings.

The key features of MVL include:

- The company must be solvent meaning it can pay its debts in full within 12 months of the MVL process starting.

- The directors of the company must make a declaration of solvency which confirms that the company can pay its debts and outlines the proposed distribution of assets to shareholders.

- The company must appoint a liquidator who will oversee the winding-up process and ensure that the assets are distributed fairly among shareholders.

- The liquidator must follow a strict set of procedures and timelines which are governed by the Insolvency Act 1986 and other relevant legislation.

- The MVL process can typically take several months to complete depending on how long it takes to get tax clearance, the complexity of the company's affairs and the number of creditors and shareholders involved.

Where net assets are more than £25,000

An MVL is commonly used when a company director is retiring and qualifies for Business Asset Disposal Relief (formerly known as Entrepreneur’s Relief)

MVLs are nearly always tax driven with Capital Gains Tax (current rate of 10%) being charged on distributions to shareholders rather than income tax at higher tax rate bands.

An MVL is a very straightforward process, although at a cost as you need specialist tax advice and a licensed Insolvency Practitioner. However, these costs can easily be outweighed by the substantial benefits in tax savings.

Also, unlike a strike-off, a company cannot be restored to the register within the next 5 years when a liquidation process is used

An MVL is different to the two other types of liquidation processes, Compulsory Liquidation and Creditors' Voluntary Liquidation (CVL) which are used when a company is insolvent and unable to pay its debts. In an insolvent liquidation, the liquidator sells assets and distributes money to creditors in order of priority for payment. The compulsory liquidation process is court driven and is usually started by a creditor whereas a CVL is instigated voluntarily by the company’s directors and shareholders. In an insolvent liquidation the liquidator must investigate the affairs of the company and make a report on the conduct of directors which can result in disqualification where there has been some wrongdoing.

Why Choose a Members' Voluntary Liquidation?

For a variety of reasons, directors may decide to enter into a Members' Voluntary Liquidation.

If a company's directors are retiring, they may choose to dissolve the company and distribute assets among shareholders.

If a company is going through a restructuring, it may be more efficient to wind it up and distribute its assets than to continue operating the business.

If a company is no longer required or its shareholders want to realise the value of their investment, they can enter into an MVL to distribute the company's assets and wind up its affairs.

There are several advantages and disadvantages to choosing the MVL as a way to wind up a company.

- As there are typically fewer creditors involved and fewer legal issues to resolve, an MVL can be less expensive than other types of liquidation such as compulsory liquidation or Creditors' Voluntary Liquidation.

- The process allows the company's directors to retain more control over the solvent company's winding-up process and asset distribution.

- An MVL can provide tax benefits to shareholders by allowing them to use capital gains rates rather than income tax rates.

The MVL procedure may also have drawbacks.

- If the declaration of solvency is incorrect or misleading, the liquidator or creditors may challenge the MVL process and seek asset recovery from shareholders.

- If company directors fail to properly declare solvency or engage in fraudulent behaviour during the winding-up process, they may face personal liability.

- If a company has outstanding liabilities that must be addressed, an MVL may not be the best option because the company will be wound up and no longer exist once the process is completed.

Finally, the decision to enter into MVL could depend on the directors and shareholders circumstances. Before making any decisions about liquidating a company, it is critical to get proper tax advice and consult with a licensed insolvency practitioner.

For more information on Fraudulent Trading read our article What is Wrongful Trading? Does it affect me?

The Members' Voluntary Liquidation Process

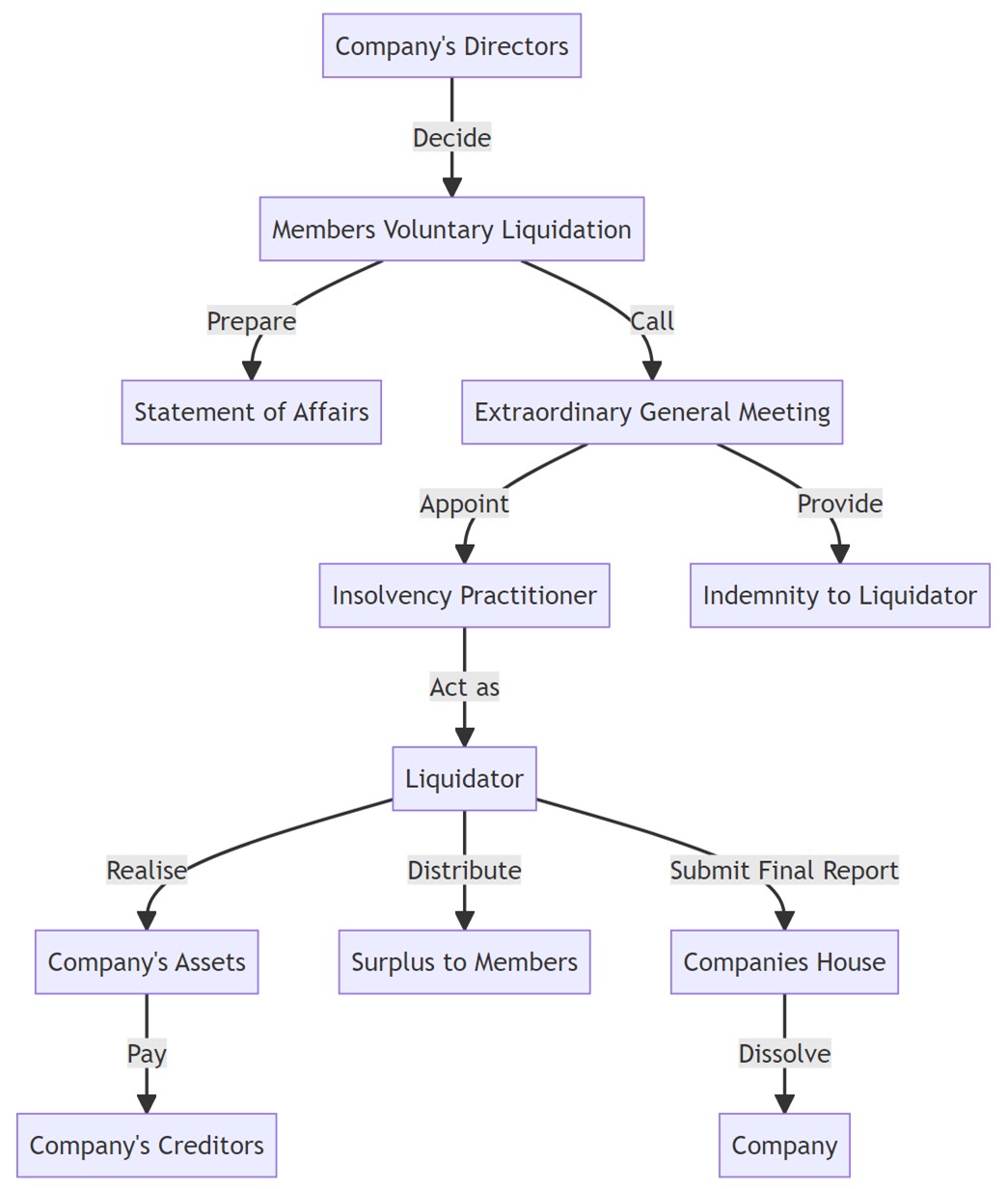

The following steps are typically included in the MVL process:

- Board of Directors meeting: The directors must hold a meeting and pass a resolution to wind up the company and appoint a liquidator.

- Declaration of solvency: The directors must make a declaration of solvency which confirms that the company can pay its debts in full within a specified period – no longer than 12 months

- Shareholders' meeting: A meeting of the shareholders must be held to approve the winding-up resolution and the appointment of the liquidator.

- Appointment of the liquidator: The liquidator is appointed by the shareholders and takes over the management of the company's affairs.

- Notification of the liquidation: The liquidator must notify Companies House and other relevant parties of the liquidation.

- Asset realisation: The liquidator must realize the assets of the company and distribute them to creditors and shareholders following their entitlements.

The MVL process typically takes between three and six months to complete although it may take longer if there are complex issues or disputes to resolve. During the process, the MVL liquidator has several responsibilities including:

- Realizing the assets of the company and distributing them to shareholders.

- Ensuring that all outstanding liabilities are paid including any tax owed to HMRC.

- Investigating the affairs of the company and reporting to creditors and shareholders as necessary.

There may be some challenges and obstacles that arise during the process including:

- Disputes among shareholders or with the liquidator.

- Challenges to the declaration of solvency.

- Issues with the realisation of assets or the payment of outstanding debts.

The liquidator and the directors of the company need to work closely together to address these challenges and ensure that the winding-up process is completed efficiently.

Impact of Members' Voluntary Liquidation

Director, shareholder, and creditor interests might all be significantly impacted by a members' voluntary liquidation. It's critical to comprehend these possible effects before moving further.

In an MVL, the company's directors are in charge of starting the procedure and making sure all legal requirements are met. In order to prove that the company can pay off all of its debts in full within 12 months of the start of the liquidation, they must present a declaration of solvency. Directors may be held personally responsible for any unpaid debts if the firm is unable to meet these responsibilities.

An MVL allows shareholders to realize the value of their investment in the company in an efficient manner. Shareholders are entitled to receive any remaining assets of the company after all of its debts have been paid in full.

In an MVL creditors are given notice of the process and are invited to submit creditor claims against the company. They are entitled to receive payment of their debts in order of priority as set out in insolvency law. Outstanding creditors may also challenge the declaration of solvency provided by the directors if they believe that the company is unable to pay its debts in full.

An MVL may have tax implications for both the company and its shareholders. Capital gains tax may be payable on any assets sold during the process and shareholders may be subject to tax on any distributions received from the company.

It is important to seek professional advice before entering into an MVL to fully understand the potential impact.

Expert Assistance with a Members' Voluntary Liquidation MVL

At Company Doctor we understand the challenges and complexities that company directors may face when considering proceeding with a members’ voluntary liquidation. That's why we offer expert assistance with the MVL process helping our clients navigate the process and achieve the best possible outcomes.

Our team of experienced professionals has extensive knowledge and expertise on the MVL process and we work closely with our clients to provide personalized service and tailored advice to meet their specific needs. With our help, our clients can benefit from cost savings, increased control and a streamlined process.

We take a hands-on approach to the MVL providing comprehensive support throughout the process, from initial planning to the final distribution of assets. Our team of MVL experts can assist with all aspects of the process including identifying and valuing assets, preparing documentation, managing creditor claims and ensuring compliance with legal and regulatory requirements.

By working with Company Doctor, company directors can be confident that they are in safe hands with a team of experts who are committed to delivering the best possible outcomes for their clients.

Conclusion

In conclusion, the members’ voluntary liquidation process is a viable option for companies looking to wind up their affairs and distribute assets in a controlled and efficient manner. The MVL provides a range of benefits including increased control, cost savings, and reduced risk, making it an attractive option for companies seeking to exit the market.

It's important to understand the process and seek professional assistance when considering liquidation. The process can be complex with a range of legal and regulatory requirements that must be met and working with an experienced MVL specialist can help ensure a successful outcome.

At Company Doctor we have a wealth of experience and we are committed to delivering the best possible outcomes for our clients. We work closely with companies and their directors to provide tailored advice and support throughout the MVL process helping them to achieve their goals and move forward with confidence.

If you are considering an MVL or would like to learn more about our services please don't hesitate to contact us at 0800 169 1536 or leave an enquiry on our website. Our team of experts are always on hand to provide support and guidance and we look forward to working with you to achieve a successful outcome.

References

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.

FAQs

A Members' Voluntary Liquidation (MVL), also known as an "MVL," is a process whereby a company with net assets exceeding £25,000 undergoes liquidation. The funds distributed to shareholders are classified as capital gains rather than income, resulting in a reduced tax rate for the remaining funds within the company.

A Members' Voluntary Liquidation (MVL) is utilised to bring an end to the affairs of a solvent company, and it is initiated by the directors and shareholders. The primary advantage of an MVL is the tax savings achieved when distributing previous profits to the shareholders.

Only the shareholders of a company have the authority to initiate a voluntary liquidation process. An authorised Insolvency Practitioner must be appointed as the liquidator. The liquidation commences upon the passing of the resolution to wind up.

Typically, the entire process of a Members' Voluntary Liquidation, from initiation to conclusion, spans from six months to a year. However, the duration may vary based on the intricacy of the company's operations.

A Members' Voluntary Liquidation (MVL) has three expenses: the fee charged by the liquidator, a bond and the statutory advertisement published in the London Gazette. Liquidators have the option to establish fixed fees and costs.

The precise amount is determined by the financial state of the business and the value and classification of its assets.

Get Help

For immediate FREE advice and guidance contact us via this online form to find out how we can help your business.

Our Services

Company Liquidation

Our licensed insolvency practitioners will guide you to the right solution, whatever your financial situation may be.

Cant Repay Bounce Back Loan or CBILS

Contact us for advice if you are unable to repay funding received, including Furlough, CBILS, CLBILS, BBLS and (SEISS).

Company Dissolution

Company dissolution (striking off), is the process of shutting down a limited company.

Winding Up Petitions

We can help if your business may be put into compulsory liquidation, or you have received a winding up petition.

Time To Pay Arrangement

We can find the best solutions and negotiate Time To Pay Arrangements on your behalf.

Directors Redundancy Claims

Did you know that many company directors are entitled to redundancy payments if the company is liquidated?

What Our Customers Are Saying